I Spent HOW much on Fast Food?

Way back in the early 1990s when DH and I first met, he was a Senior at a university in Illinois and I was attending a small university in Iowa. After he graduated, he passed up a few job opportunities elsewhere and moved to the same city that I was attending school. Like most college grads, there was a fine balance between spending habits and income.

As we strengthened our relationship and eventually got married, we focused on our finances. When one of my brothers told me that he used Quicken to keep track of all his money, including cash, I thought he was nuts. He said he set up a cash account in Quicken then routinely logged his spending. If he had $30 in cash in his pocket then spent $5.50 on lunch, he tallied $6 as “Fast Food”. He said he rounded up to the dollar and threw change in a jar. His Quicken cash account then read $24 which would (well, should) match what he had in his pocket.

I’m pretty frugal so I was intrigued by his idea. I purchased Quicken and proceeded to set up all our credit cards, bank accounts and loans. I also set up a cash account and figured we would give it a shot.

While it seemed to be a bit of a headache at first, I found the results to be astonishing. When I ran reports to check our spending, I about fainted when I saw how much we spent on fast food in the short amount of time since I started tracking our spending in such detail. $2 here, $3 there, a buck in the pop machine, chipping in on lunch with coworkers. It was very insightful. Frighteningly insightful.

As we matured financially, we continued to use financial software (MS Money) and maintained strict records. Using different strategies, we paid off our credit cards and have managed to do that each month since.

One thing that has been a constant all these years is our Discover Card. We had it way back in college when you could make in-person payments at the local Sears store. They offered cash back. At the time, other cards seldom had value incentives and if they did, it was usually airline miles. Discover offered cash. Money. Something tangibly spendable. Something of total value for any person who considers Ramen Noodles a typical meal. It quickly became our card of choice any place that we could.

As Discover became accepted at more locations, we used it more often. Now, I carry a metal business card holder with my license, my Discover card, my backup credit card and $5 cash. I hardly ever bring a purse with me. I seldom even take my checkbook out of the house. Whether I’m paying hundreds for an airline ticket or car insurance or just a few bucks for fries at McDonald’s, you can bet I’m using my Discover Card. Why? Because there’s a guaranteed cash back as well as bonus cash back for various promotions throughout the year.

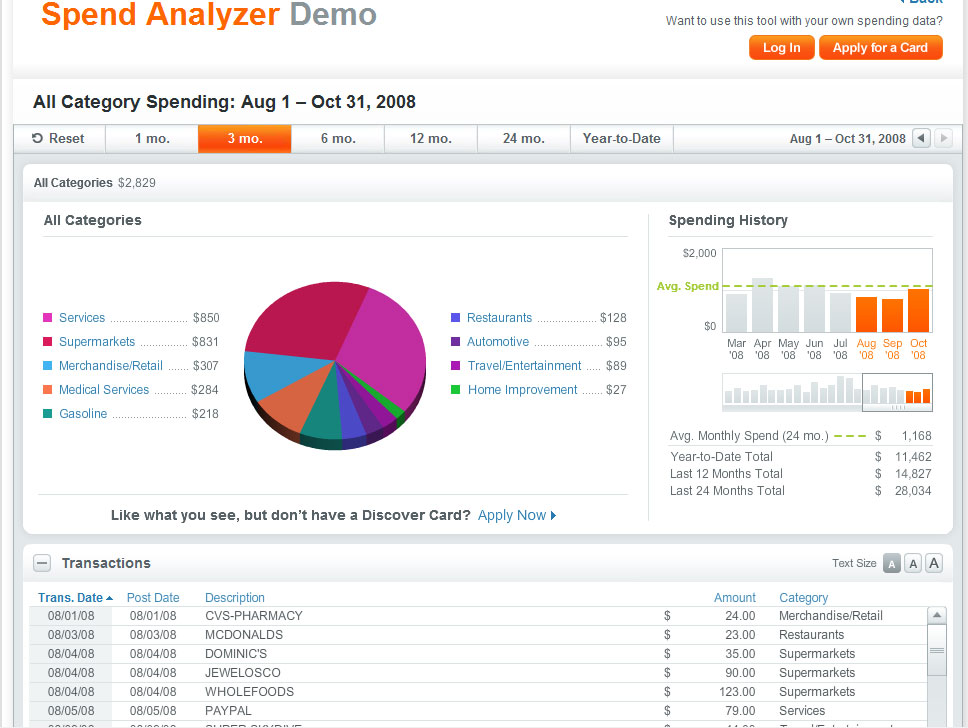

I was recently introduced to a new Discover Card feature – Spend Analyzer. It was actually a little embarrassing because I’m on the Discover website all the time checking on promotions, cash back or just my account. Yet I hadn’t discovered this new tool. (Get it, discovered? Ha! I crack myself up.)

When I loaded up the Spend Analyzer demo, I immediately had flash backs to those early days when we first started tracking our spending. I threw out the demo and headed straight for my live account to see the true wealth of information the Spend Analyzer has to offer. For someone who uses Discover as religiously as we do, this tool is a dead-on indicator of our spending habits.

Before I go any further, let me say that it’s not a perfect system and Discover acknowledges that in their Spend Analyzer FAQ: Their example – School supplies purchased at a grocery store will show up under the “Supermarket” category instead of “Education.” While this doesn’t give as detailed a breakdown as a financial software program, it is completely painless. It’s also free, doesn’t require any additional work or financial education and it’s accessible right from the Discover page when you log in to your account.

Maybe it’s just the accountant in me, but I think it’s a very cool feature. It grabs details for ranges of 1, 3, 6, 12 or 24 months or simply year-to-date. Click any month to get the breakdown for that month. From there you can click on any of the other ranges and it gets the details for that specific range. The only aggravating part is that if you highlight over a month, it tells the “Largest Category” and the “Most Frequent Category” of spending for the month you select. Why do I find that aggravating? Well, simply put – there is no hiding from the truth with the Spend Analyzer. Sigh.

Speaking of categories, you can get a great deal of detail by clicking on a category in the pie chart. For example, click on “Restaurants” and it gives the breakdown of all the different restaurants you charged for the month. Better yet, it breaks it down by location so if you and your spouse both frequent a Starbucks by your respective employers, then it shows. Great tool for pinpointing spending but once again, no hiding from the truth with the Spend Analyzer. Sigh.

Want to save the data or print a copy to review? There’s the ability to print a hard copy or save to a .PDF file. For reference, don’t try to match the numbers up to your statement because it won’t work. The Spend Analyzer charts the data by calendar month whereas monthly statements don’t close the final day of each month.

Just like my spending revelation back in the early 1990s, tools like the Spend Analyzer help people recognize how they are spending their money. Nickels and dimes tend to add up more than people realize. Financial knowledge is a huge asset at any point in time, but during economic struggles, it’s even more important.

If you have a Discover Card, log into your account, click on the “Tools and Advice” tab and check out the new Spend Analyzer. If you don’t have a Discover Card, it’s worth checking out!